Personal Guarantee Commercial Lease - The Facts

Protection deposits can be a major worry on renters, especially start-up occupants who may not have access to cash they can offer to the property owner to hold for an extended period of time. When it is not practical (or impossible) to offer the proprietor sufficient safety with just a protection down payment, the celebrations will typically think about a letter of credit scores to either supplement or change a safety and security deposit.

/GettyImages-102895484-5701beff3df78c7d9e6558a7.jpg)

Basically, it is a down payment in the kind of debt advanced by a 3rd party institution (usually a bank). Letters of credit rating been available in 2 major types, commercial and standby. For objectives of industrial leasing, we are chatting only concerning the standby letter of credit. The way the letter of credit history jobs is that the occupant will most likely to its banker as well as ask for a letter of debt for the property owner.

If the financial institution decides the tenant is creditworthy, after that the bank will provide a letter of credit history guaranteeing the tenant. The letter of credit score is generally literally a letter signed by the financial institution that claims the financial institution will certainly provide a certain amount of cash to the property owner if the landlord contacts the financial institution and accredits that the renter is in default.

Letters of credit score are often negotiated, both between the proprietor as well as tenant as well as in between the tenant and also the bank. Among the significant issues is whether the proprietor will need to supply any kind of evidence of real lease default prior to the financial institution is called for to pay on the letter of credit history.

How Personal Guarantee Commercial Lease can Save You Time, Stress, and Money.

And the occupant would choose the bank ask questions prior to turning over the cash. You ought to comprehend what your property manager has to do in order to access to the letter of credit, consisting of whether the proprietor must first look for payment from various other resources. Additionally, due to the fact that a letter of credit report can be pricey (normally a couple of percent of the equilibrium annually just to keep the letter in force), the tenant will intend to take into consideration changing the letter of credit as quickly as the property owner is willing to allow it go.

A letter of credit can be a very useful tool for property owners as well as lessees to compromise relating to credit reliability, and also they are made use of usually, especially in bigger deals where the cost of the letter of credit score is more easily taken in. You need to understand whether a letter of credit history will benefit you, what other alternatives could be available, as well as the certain terms of the letter of credit score, prior to accepting provide one.

A personal guarantee (alternatively written as "personal guaranty") is an additional usual kind of credit scores enhancement. It is a guarantee by one or even more individuals that a 3rd party occupant (generally the limited obligation entity whereby the people are negotiating business) will pay according to the regards to the lease.

An individual guarantee can be a powerful kind of credit improvement as well as is another device made use of to supplement (yet typically not change) a down payment. Individual warranties prevail when the renter is a limited obligation entity, such as an LLC, without a recognized operating background and also without substantial possessions - how to get out of a personal guarantee on a commercial lease.

More About How To Get Out Of A Personal Guarantee On A Commercial Lease

As a result of this, property managers will typically require that minimal liability entity proprietors personally assure the lease commitments. The personal guarantee resembles the letter of credit history in that it offers the proprietor much more certainty of being paid in the event the occupant is not able or unwilling to put up a huge adequate safety and security deposit to make the property owner comfortable.

The regards to a personal guarantee frequently differ, and also the a lot more heavily bargained terms border whether the proprietor must initially go after the tenant prior to going after the individual guarantor. Commonly, the property owner wants the choice to go after the individual guarantor without having actually currently gone after the renter, where an individual guarantor wants the contrary.

You should fully comprehend the personal assurance prior to signing, as signing an individual assurance significantly threatens the objective of having a restricted responsibility entity and subjects the personal guarantor to significant individual risk. personal guarantee commercial lease. Picture: p_d_s Flickr Gideon has fly fished for trout in rivers on 3 continents.

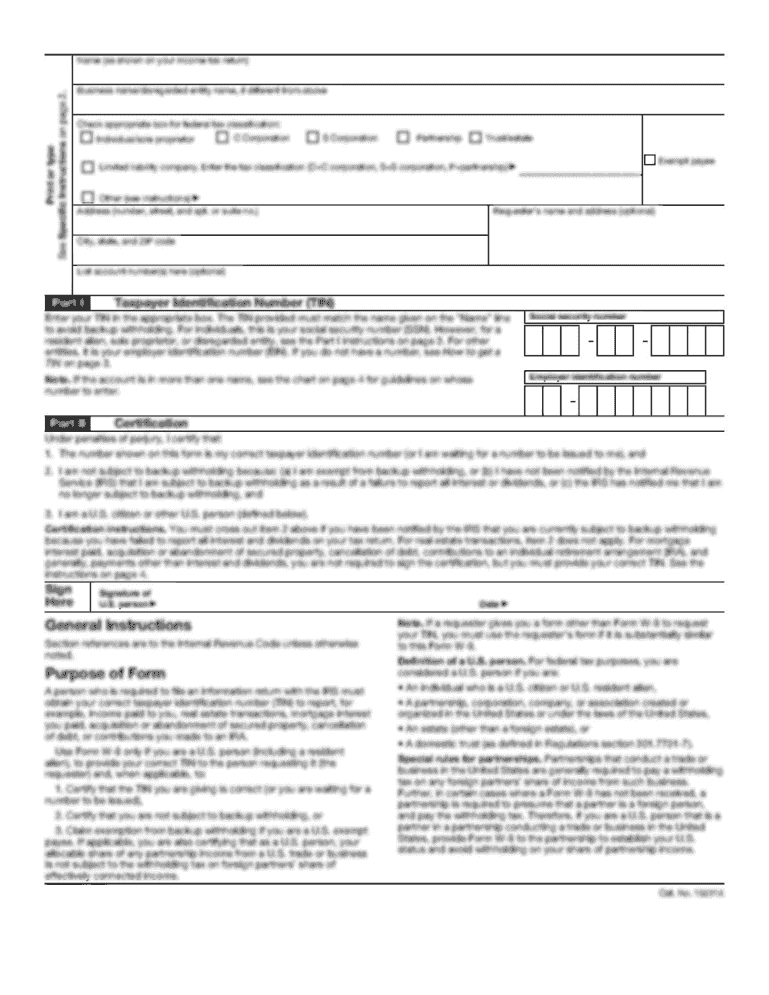

Program details Hide information AGREEMENT OF PERSONAL GUARANTY ATTACHED TO As Well As MADE PART OF THE LEASE CONTRACT DATED 20 BETWEEN PROPRIETOR As Well As RENTER The witnessed Guarantor in factor to consider of the production of the foregoing Lease Arrangement in between Occupant as well as Proprietor does thus unconditionally guarantee the settlement of the rent by the Occupant and also the efficiency by Lessee of all the monetary duties as well as commitments under the Lease Arrangement.

The smart Trick of Breaking Commercial Lease Personal Guarantee That Nobody is Talking About

In my 35 years of experience as an entrepreneur as well as lease mediator for company America as well as tiny organisation owners, one of the most typical aspect for a lot of small organisation proprietors when signing a lease is the individual guaranty vs. a corporate warranty for huge corporations. I'm often asked by local business owner if the individual warranty can be omitted when signing a lease. breaking commercial lease personal guarantee.

There are a couple of exceptions when an industrial landlord will approve a letter of debt or other considerable collateral instead of the guaranty, however 99% of the moment, an individual guaranty can not be stayed clear of. There are numerous factors for this demand (personal guarantee lease). First, the proprietor wants guarantees the lease commitments will certainly be met by the local business owner, and also as an incentive, they want the lease backed by the personal guaranty, for that reason, making it extra difficult for the organisation owner to simply ignore the lease if the service is refraining well or along with expected.

There are, nonetheless, some approaches to discuss these individual assurances that can be employed in renting purchases. The most recommended method is to utilize a limited or rolling guaranty. These methods are often acceptable to property managers, relying on the company proprietors' credit rating, monetary picture as well as organisation experience. The stronger the certifications, the better odds of being able to work out.

you could check here